What Does it Really Cost to Run an Electric Car?

Friday 8th March 2024

Last updated: 4th February 2025

There are over a million battery-electric vehicles on Britain’s roads today and the number of new EVs registered in 2023 was nearly 40% higher than the previous year.

It’s a trend that is set to continue, with 54% of people now likely to choose an EV or hybrid vehicle as their next car. That said, many current and prospective EV drivers are concerned about the cost of charging, especially away from home. So let’s take a look at what it really costs to run an electric vehicle.

Are EVs more expensive upfront?

Over recent years, when comparing cars of a similar size and specification, the electric option has typically cost far more than its petrol or diesel equivalent. The good news is that, for a number of reasons, we will soon see lower upfront costs for a wide range of electric vehicles.

The first reason is simply a question of supply and demand. Although the ban on selling new petrol or diesel-only cars and vans has been pushed back to 2035, the government’s ZEV mandate states that manufacturers must hit a minimum percentage of EV sales, or receive heavy fines.

In 2024, 22% of all new car sales must be zero-emissions. This target figure then rises each year until it hits 80% in 2030 and 100% in 2035. As a result, manufacturers will come under increasing pressure to sell enough EVs to meet their target and, when there are sales targets to hit, this is generally good news for prospective buyers. To put this in perspective, in January 2024, battery-electric vehicles accounted for 14.7% of all new car registrations. That’s 33% below the target figure manufacturers need to achieve.

The second reason prices are likely to fall is that EV manufacturers who are new to the UK, such as ORA and BYD, must be competitively priced to gain market share. And there are more on the way, including Omoda, XPeng, and Nio — who are looking to set up a battery swap infrastructure. This will introduce even more competition to the market. And as we all know, increased competition means lower prices.

How much does an EV cost to charge?

Before we talk about how much, we need to discuss where. There is currently — and will likely always be — a big difference between the cost of public and home charging.

The average range for new electric cars entering the UK market is just under 300 miles. That’s well over twice the average weekly mileage of most drivers. In other words, if you can charge at home, the use of public charging points is likely to be occasional at most, making the price differential less important.

The actual cost of charging at home varies depending on the time of day and tariff chosen but, by shopping around, it is possible to get rates of just 7p/kWh. Depending on the vehicle driven, this can work out at less than 3p per mile. That’s over 75% cheaper than a diesel car running at 50mpg.

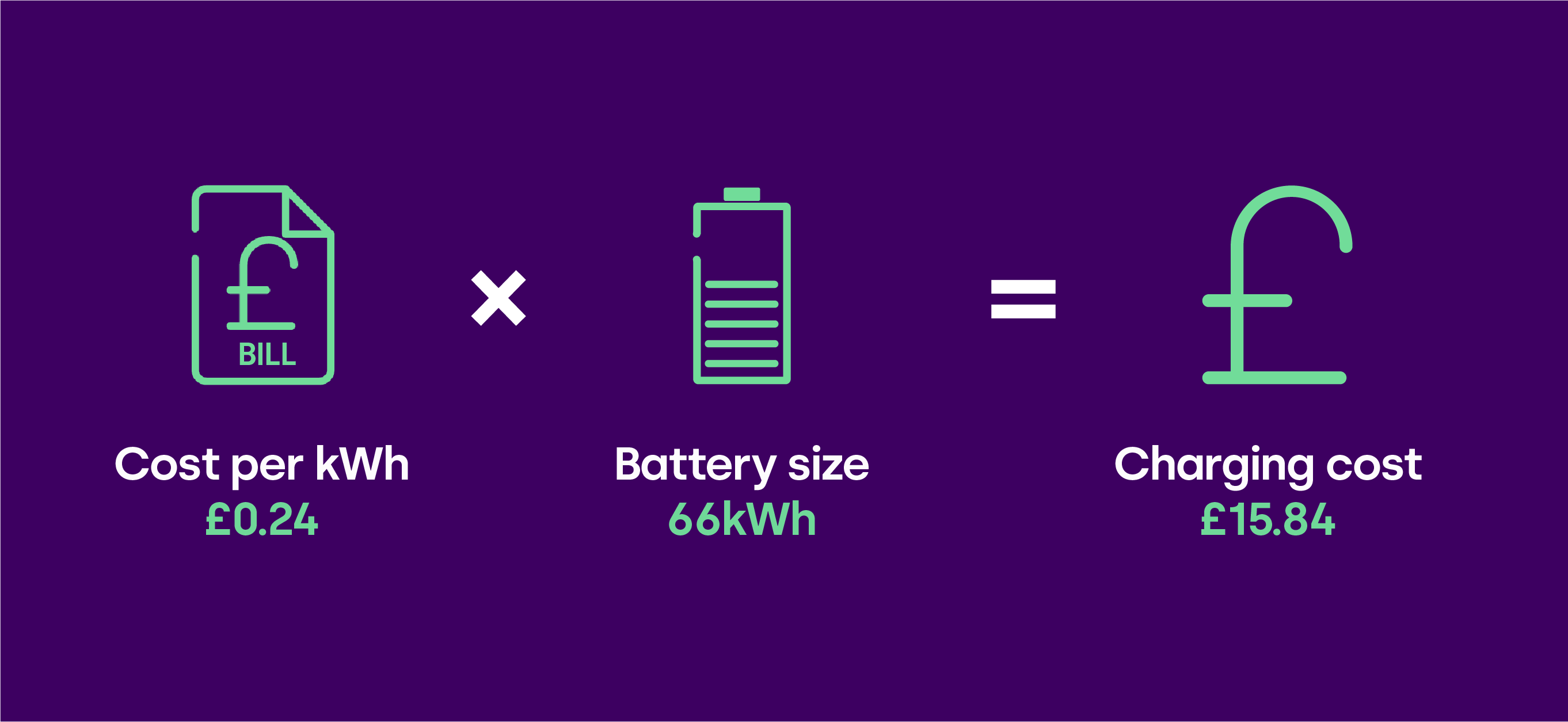

If you would like to work out the cost of fully charging an EV for yourself, the formula to use is:

In fairness, we also need to factor in the upfront cost of installing a home charge point. This is generally £800 to £1,000 but, if you live in a flat or rental property, you may be able to benefit from the government’s electric vehicle charge point grant which offers a discount of 75% off the cost of buying and installing a charger, up to a maximum of £350.

Charging on the road isn’t anywhere near as economical. If you are using one of the 31,000+ public locations across the UK then you could be looking at 56p/kWh for slow/fast chargers and up to 80p/kWh for rapid/ultra-rapid charging. That’s quite a difference. In fact, at 61p/kWh it starts to become cheaper to drive an equivalent diesel car, or it would be if the cost of fuel was all that mattered.

Servicing and repairs

An electric car has around 90% fewer moving parts than one powered by a traditional internal combustion engine. This means there are fewer things that can go wrong or need to be replaced due to standard wear and tear.

It’s important to remember that EVs still need to be serviced at regular intervals. However, research shows that the average cost of servicing an electric car is 45% less than diesel and 38% cheaper than petrol models. Whichever way you look at it — frequency of repair or the cost of regular servicing — you pay a lot less with an EV.

Congestion and Clean Air Zones

There are a growing number of Congestion and Clean Air Zones (CAZ) up and down the country. Rates vary but, for non-compliant vehicles, you can expect to pay at least £8. In the case of areas controlled by Transport for London, you could be hit with a double whammy, paying both a congestion charge and a separate fee for entering the Ultra Low Emission Zone (ULEZ).

As a one-off payment, these charges might not be too bad but, if you need to enter these areas regularly, then it can start to add up. There are also emission-controlled zones in places such as Bradford or Bath that don’t currently charge private drivers but may do so in the future.

Taxation

In the UK, average CO2 emissions are 138.4g/km which, based on a diesel that meets the RDE2 (Real Driving Emissions step 2) standard, or a petrol vehicle, with a list price of £40,000 or less, currently means paying £255 per year in first-year road tax and then the standard rate of £180. It’s also worth noting that these rates are set to rise in line with inflation for the next few years at least.

Drivers of an equivalent electric vehicle pay nothing at all. However, this will change to the standard rate from April 2025. Vehicles registered on or after 1 April 2025 will pay the lowest first-year rate, which is currently £10.

In addition to road tax, company car drivers pay Benefit in Kind (BiK) tax based on the value of their car. The fact that many businesses limit their employees’ choice to lower-emission vehicles has resulted in a 30% reduction in average company car emissions (excluding EVs) in just 10 years. Even so, with the average non-electric company car emitting 103g/km, this results in a BiK bill based on 25% of the car's P11D value, multiplied by the driver’s standard income tax banding.

Depending on how the vehicle is used, its exact specifications, employee capital contributions, and personal tax arrangements, this could mean paying thousands of pounds in tax each year.

As an example, let's take a car with a P11D value of £30,000 and emissions of 103g/km. With no additional capital contributions, this would mean paying tax — at the driver's regular rate — on £7,500 each year. Switch to a battery electric vehicle with zero emissions and the taxable value falls to just £600.

Even bigger savings

There are even bigger savings on offer to employees who make use of a government approved scheme known as Salary Sacrifice. It works by enabling employees to give up — or sacrifice — a portion of their pre-tax salary in return for a brand-new car. In other words, the car is paid for before any income tax or national insurance is calculated.

It only really works for electric cars, but the net effect is that income tax is replaced by Benefit in Kind tax. So instead of paying 20% or 40% tax on the money used to lease a new EV, it’s just 2% (based on 2023/24 tax rates). What’s more, National Insurance is only paid on the amount of salary received after the car has been paid for.

So... what does it really cost to drive an EV?

As we’ve seen, the cost of driving an EV depends on a number of factors, including the cost of the car itself, where it’s charged, the number of miles driven, and personal tax arrangements. As a result, it’s worth taking the time to do some personal research and weighing up the pros and cons before making a final decision.

To find out more about how Novuna Vehicle Solutions can help, just get in touch.