Autumn Statement 2023 Key Highlights

Monday 27th November 2023

Last updated: 4th February 2025

In this years Autumn Statement Jeremy Hunt presented a positive story of growth in the economy, with both inflation and debt decreasing, or as Mr Hunt put it “our plan for the British economy is working, but the work is not done."

The Office for Budget Responsibility (OBR) expects the economy to grow by a higher than expected 0.6% this year, but there has also been a sharp downgrade in the economic forecast for 2024 and 2025, with growth now predicted to be 0.7% and 1.4% respectively.

Inflation has fallen from its 41-year high of 11.1% in October 2022 to 4.6% and the OBR predicts that this will continue to fall to 2.8% in 2024 and 2% by the end of 2025. The Bank of England has successfully used higher interest rates to bring down inflation which means that, after many years of low returns, savers have at last been rewarded for their fiscal prudence. On the other hand, those with mortgages and other borrowings, have seen repayments soar.

Our primary focus is of course on matters impacting drivers and business fleet operators and, with this in mind, here are the key takeaways from the 2023 Autumn Statement.

1. National Insurance down, tax burden up

The main rate of National Insurance is set to go down from 12% to 10%. Slightly unusually, this will be effective from January 2024, which may hint at a Spring election. On the flip side, with NI and income tax thresholds static since 2021, rising wages mean that, in real terms, more people are paying more tax and, for some, this completely wipes out the savings from lower rates of National Insurance.

Despite the fall in NI, using a Salary Sacrifice scheme that utilises pre-tax earnings to finance and run an electric or plug-in hybrid car still makes sound financial sense for many drivers. That said, with the national living wage set to increase by 9.8% to £11.44 per hour, the eligibility threshold will increase, so it may not work for some lower income employees.

With no adjustment to Class 1A rates, employers won’t see any reduction in their payments, but a Salary Sacrifice scheme is still likely to be the most cost-effective option for businesses wanting to help drivers switch to carbon-free motoring. However, it is important that the scheme’s design is aligned with your financial and environmental objectives, so it’s worth assessing these changes carefully to ensure the scheme continues to work for everyone involved.

2. Full expensing made permanent

On April 1 2023, the super deduction was replaced with full expensing for three years, allowing businesses to write off the full cost of qualifying plant and machinery. This has now been made permanent and can be applied to vans, trucks, tractors etc. but not to cars or vehicles bought for the purpose of leasing.

In principle, full expensing is designed to encourage investment and it will make a big difference for some companies, but the exclusions mean businesses are unable to access the full range of finance options for every asset.

Paulo Larkman, Head of Fleet Consultancy at Novuna Vehicle Solutions adds "We have been working with the BVRLA, PWC and others to lobby the Government to remove the leasing exclusion from this legislation which would be a benefit for our customers. Whilst this was not announced by the Chancellor, the BVRLA and Novuna remain confident this may happen in the future.

The government has launched a full expensing technical consultation to determine whether broader changes could be made and it expects to draft legislation in Summer 2024, so we will need to wait and see whether there are more changes on the horizon.

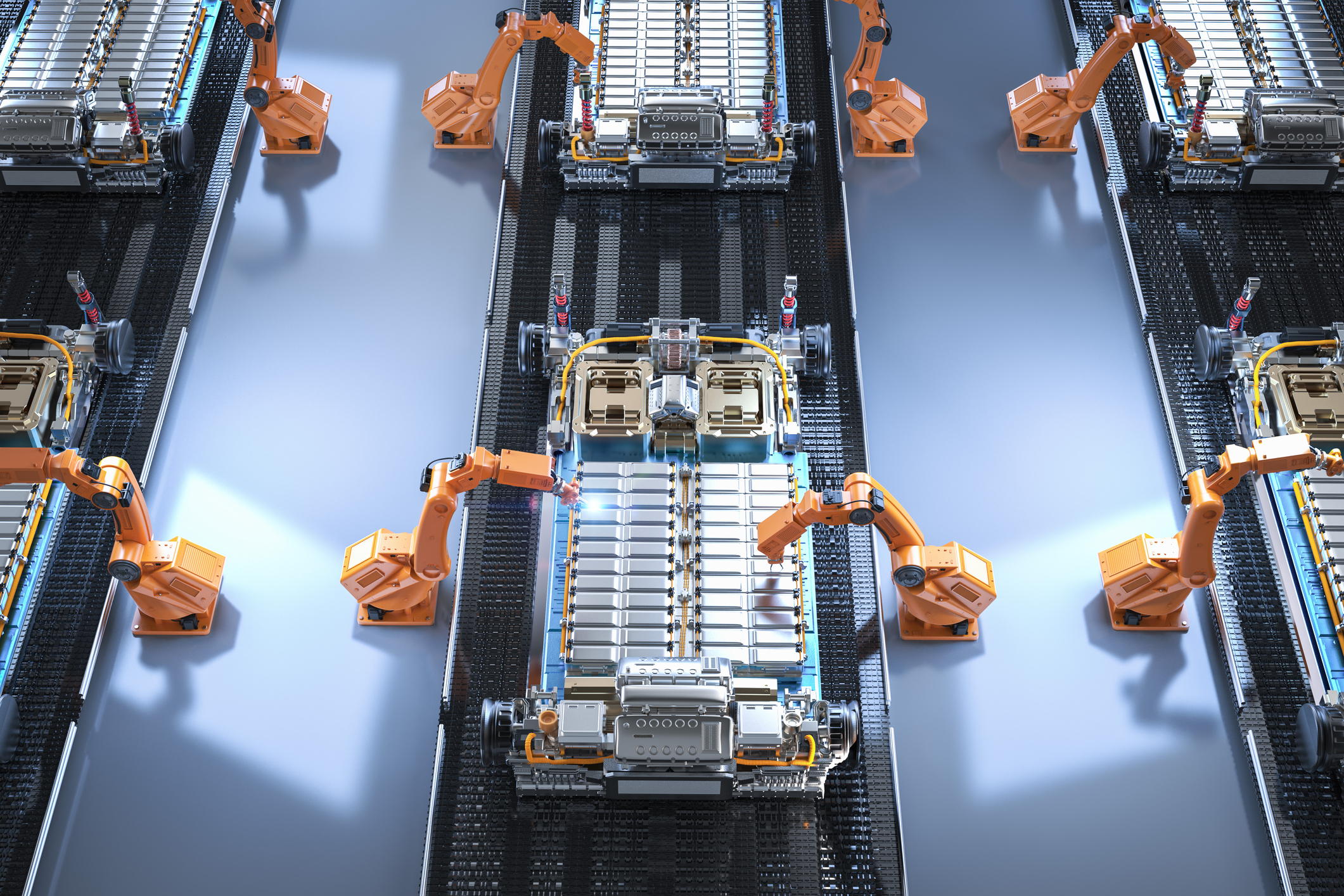

3. £2bn for zero-emission vehicle manufacturers

As part of the government's drive to decarbonise transportation, manufacturers will benefit from a share of £2bn over five years from 2025. The funds have been earmarked for the manufacturing and development of zero-emission vehicles, their batteries and supply chain.

The money is part of a larger, £4.5bn pot designed to unlock private investment in strategic manufacturing sectors, which includes £975m for the aerospace sector to support the development of energy efficient and zero-carbon aircraft technology.

4. Extra funding for clean energy and carbon capture

A £960m Green Industries Growth Accelerator (GIGA) designed to support clean energy manufacturing capacity across the UK has been announced. This includes Carbon Capture Utilisation and Storage (CCUS), hydrogen, offshore wind, electricity networks, and nuclear.

5. Faster Grid access and prioritising EV chargepoints

The Chancellor recognised that clean energy businesses are facing long delays in accessing the grid and Mr Hunt pledged to reduce wait-times by 90% by reforming the grid connection process and freeing up over 100GW of capacity so that qualifying projects can connect sooner. This could mean a connection in under six months, a significant improvement on the five-year wait faced by some projects.

A Connections Action Plan has also been published with the aim of halving the time to build new grid infrastructure to seven years and low-carbon infrastructure will now be designated as a critical national priority, with a consultation on amending the National Planning Policy Framework to prioritise the rollout of EV chargepoints and hubs set to be launched. Exactly when this will be and the impact it will have remains to be seen.

6. £50m for battery innovation

As part of a £145m investment package through Innovate UK — the arms-length government agency that provides money and support to organisations delivering new products and services — £50m has been set aside for battery innovation.

7. £500m additional funding for artificial intelligence

For many people, the launch of ChatGPT signalled a step-change in awareness of the capabilities and dangers of artificial intelligence. For the fleet industry, the implications could be huge, revolutionising the collection and analysis of vehicle and driver data, decision-making, safety, productivity and, of course, driverless cars.

The additional £500m over the next two years is to “help universities, scientists and start-ups have access to the compute power they need to help make the UK an AI powerhouse”.

The government will also be investing £100m in a new AI Safety Institute to help balance innovation and safe adoption and will look to publish its response to the AI white paper by the end of the year.

8. £8.55bn for City Region Sustainable Transport Settlements (CRSTS2)

The Spring Budget included £8.8bn for the second round of CRSTS2, which is designed to help regions achieve their net-zero ambitions by changing the way people travel and to improve the sustainability of existing transport frameworks. This has been followed up with a further £8.55bn funded through savings made by cancelling the extension of HS2 beyond Birmingham.

9. No change to van benefit or car and van fuel benefit charges

There will be no change to either the Van Benefit Charge or the Car and Van Fuel Benefit Charge. Currently, the van benefit is set at £3,600, the car fuel benefit multiplier at £25,300 and the van fuel benefit at £688. These levels will now also apply in 2024/25.

10. Vehicle Excise Duty (VED) uprating

The VED rate for cars and vans will be uprated in line with RPI from April 1 2024. However, the VED for HGVs and the HGV levy will both remain at 2023/24 rates for 2024/25.

11. No change to fuel duty

Prices at the pump may have fallen since their July 2022 peak of 191.6 and 199.2 pence per litre (ppl) for petrol and diesel respectively, but they still have a long way to go to reach the norms of the last decade or so. There had been hope that fuel duty would be cut from the current 52.95ppl, but it was not to be. With fuel costs a major factor for fleets of all sizes, we will need to wait and see whether the Spring Budget brings any relief.